DEFINITION

In accordance with Section 4 of the Negotiable Instruments Act, 1881, —

A “Promissory note” is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking, signed by the maker, to pay a certain sum of money only to, or to the order of, a certain person, or to the bearer of the instrument.

PARTIES

1. Maker: The person who makes a promise to pay is called the Maker. He draws the promissory note, and must sign the instrument to make it valid. A Maker is also called the Drawer or the Payer or the Debtor.

2. Payee: The person in favor of whom the instrument is drawn, to whom the amount mentioned in the promissory note is payable is called the Payee or the Drawee or the Bearer or the Creditor.

TRAITS

1. Written: A promissory note to be valid must be in writing. An oral promise cannot be called as a promissory note, and therefore cannot be enforced.

2. Stamp: A promissory note must be stamped in accordance with the prevailing stamp laws of the respective state, and such stamp must be canceled properly by maker's sign or initial on it.

3. Amount: Promissory note is invalid if no amount is payable to the Payee. There should be a promise to pay a certain sum.

4. Promise: Mere acknowledgement of debt is not sufficient to make the note valid. There must be an express promise to pay.

5. Unconditional: The promise to pay should be definite, without any conditions attached to it. Instruments payable on the happening or non-happening of an event are not valid.

6. Money: A promise to pay anything except money makes a promissory note invalid. The promise should be only to pay money, not to pay in kind.

7. Signature: The maker of the promissory note must duly sign it. Otherwise, it would invalidate the instrument in toto.

8. Different: The maker and the payee must be two different persons. The instrument cannot be made payable to the bearer.

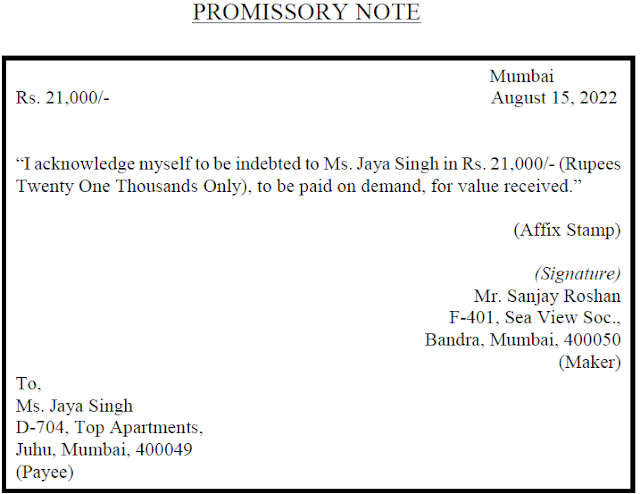

SPECIMEN

Thanks for the information. It was easy to understand with your simplistic explanation.

ReplyDelete